Understanding Tail Risk

Allocating across a diversified range of asset classes can help manage overall portfolio risk. From time to time, however, severe market shocks may occur that are so extreme and unexpected they trigger widespread declines and can devastate a portfolio strategy.

What are tails?

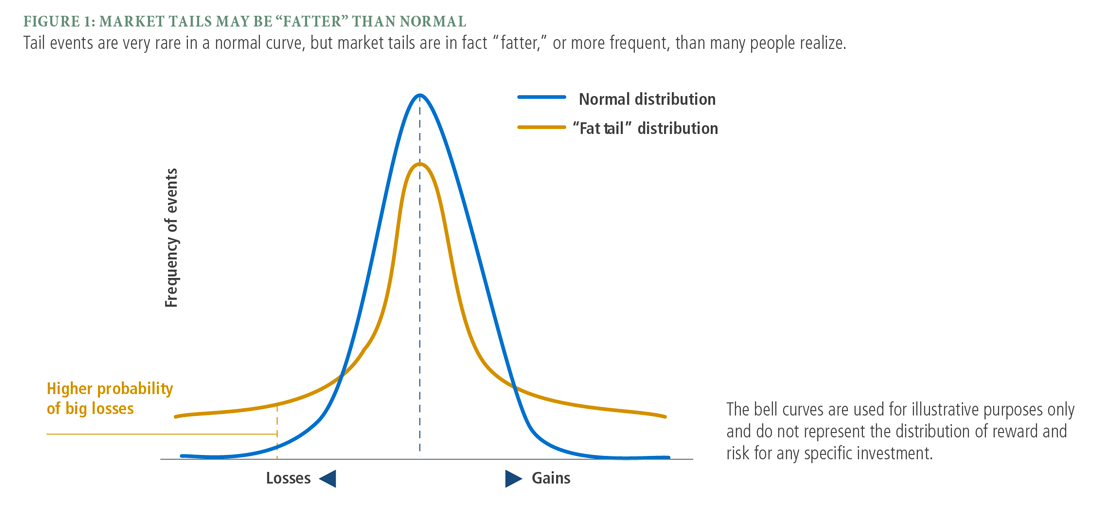

“Tails” refer to the end portions of distribution curves, the bell-shaped diagrams that show statistical probabilities for a variety of outcomes. In the case of investing, bell curves plot the likelihood of achieving different investment returns over a specified period.

As shown in Figure 1, in a normal bell curve, the most probable returns are concentrated in a bulge near the center, which is the average expected return, or the mean, with less probable, more extreme returns tapering away toward the edges. The tails on the far left and far right represent the least likely, most extreme outcomes: lowest returns on the left, highest returns on the right. For long-term investors, the ideal portfolio strategy will seek to minimize left tail risk without curtailing right tail growth potential.

Tails may be “fatter” than expeaffected

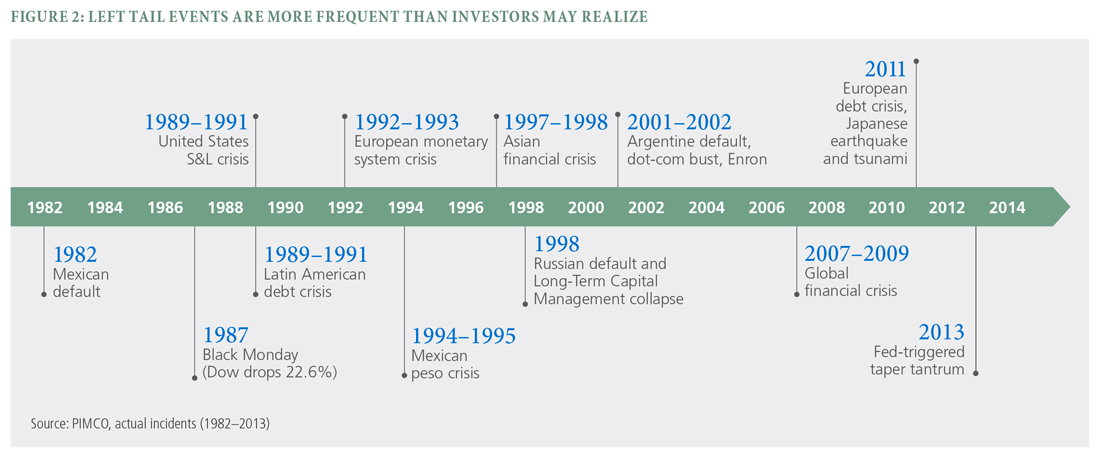

Traditional portfolio strategies often rely on normal bell curves to make market assumptions, but in reality, markets tend not to behave “normally.” Periods of financial stress have appeared with more frequency than many investors might think, and on an increasingly global scale. By some estimates, over the past three decades significant market shocks have occurred about every three to five years, resulting in “fatter” tails than a normal curve would predict, as shown in Figure 2 below.

These unexpected systemic shocks quickly spread panic across markets, creating a downward spiral of declines across a broad spectrum of investments. Since they are so widespread and their magnitude so difficult to predict, left tail events can have a devastating impact on portfolio returns – and potentially impede investors’ ability to achieve their financial objectives.

Preparing for the unpredictable

Tail risk hedging can be an appropriate strategy to help investors pursue their objectives, without having to significantly adjust their risk and/or return expectations after a market crisis. There are a number of ways investors can employ tail risk hedging. One method is to limit asset allocation risk by weighting portfolios to less volatile sectors. Another method is keeping asset allocation constant, then complementing it with strategies such as equity puts, credit protection, currency and interest rate options.

Strategies involving derivatives present special risks. It can be difficult to close out derivatives positions in certain market conditions, and with certain derivatives, it’s possible to lose more than the principal of the investment. Given the complexity of actively managing and implementing these hedges, expertise is critical, which is why many investors and financial advisors look to professional investment managers to add such a strategy to their investment plans.

Is tail risk hedging expensive?

Hedging strategies may have some near-term costs, but over time, they are designed to enhance return potential by:

- Mitigating losses when a market storm hits;

- Providing liquidity in a crisis, allowing investors to buy assets at fire-sale prices as others are forced to sell and

- Allowing investors to take greater risks elsewhere in their portfolios.

Ultimately, the potential to add value during a crisis may more than prove the worth of tail risk hedging over the long term.

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

A word about risk: Past performance is not a guarantee or a reliable indicator of future results. Diversification does not ensure against loss. Tail risk hedging may involve entering into financial derivatives that are expected to increase in value during the occurrence of tail events. Investing in a tail event instrument could lose all or a portion of its value even in a period of severe market stress. A tail event is unpredictable; therefore, investments in instruments tied to the occurrence of a tail event are speculative.

This presentation contains the current opinions of the manager and such opinions are subject to change without notice. This presentation has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this presentation may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark or registered trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2022, PIMCO.